My payroll calculator

Get the latest financial news headlines and analysis from CBS MoneyWatch. Find the banks that offer free checking.

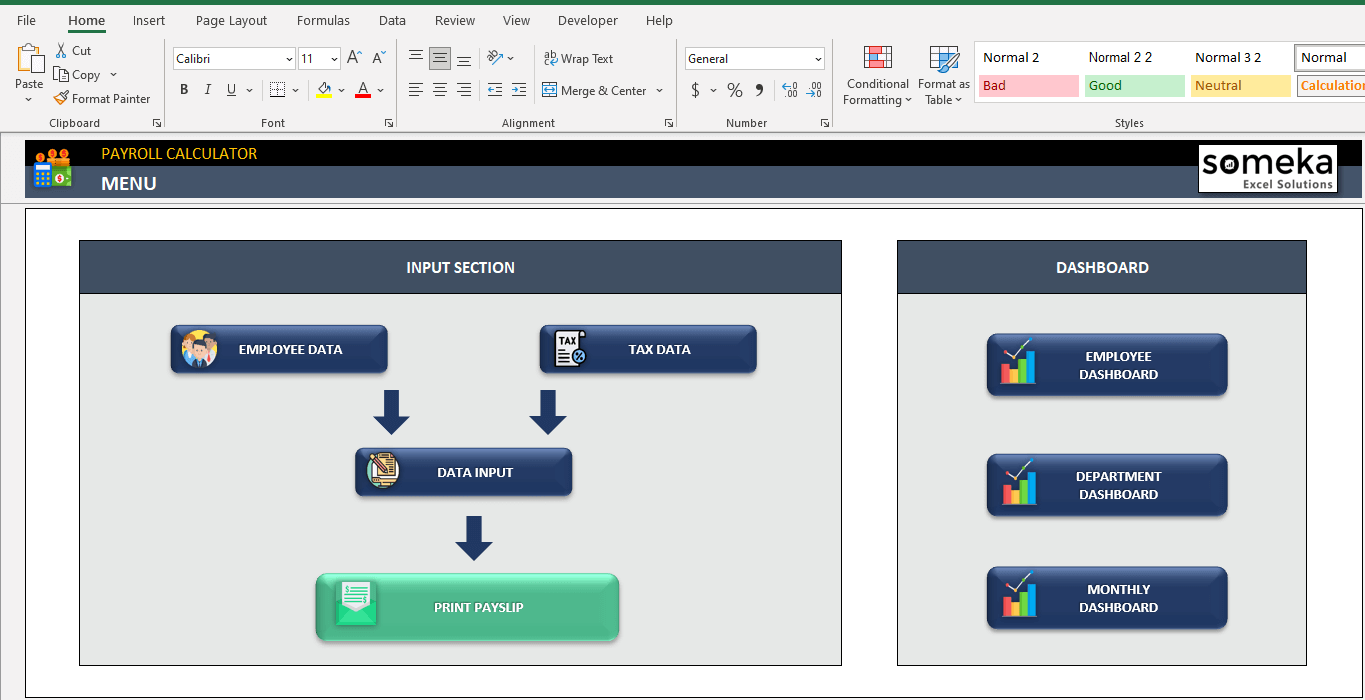

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

They make it simple and easy.

. Payroll Withholdings Calculator Should I adjust my payroll withholdings. This calculator is intended for use by US. Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income TaxTax is usually deducted automatically from wages pensions and savings.

Current SurePayroll Customers. Form 1040-ES contains a worksheet that is similar to Form 1040 or. No the calculator assumes you will have the job for the same length of time in 2022.

Exempt means the employee does not receive overtime pay. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s are accurate. The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan.

Easy to use Payroll Calculator in Excel. Form 1040-ES Estimated Tax for Individuals PDF is used to figure these taxes. Use this handy tool to fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right the first time around.

One of the most powerful things about this spreadsheet is the ability to choose different debt reduction strategies including the popular debt snowball paying the lowest balance first or the debt avalanche paying the highest-interest first. It can also be used to help fill steps 3 and 4 of a W-4 form. Use our free check stub maker with calculator to generate pay stubs online instantly.

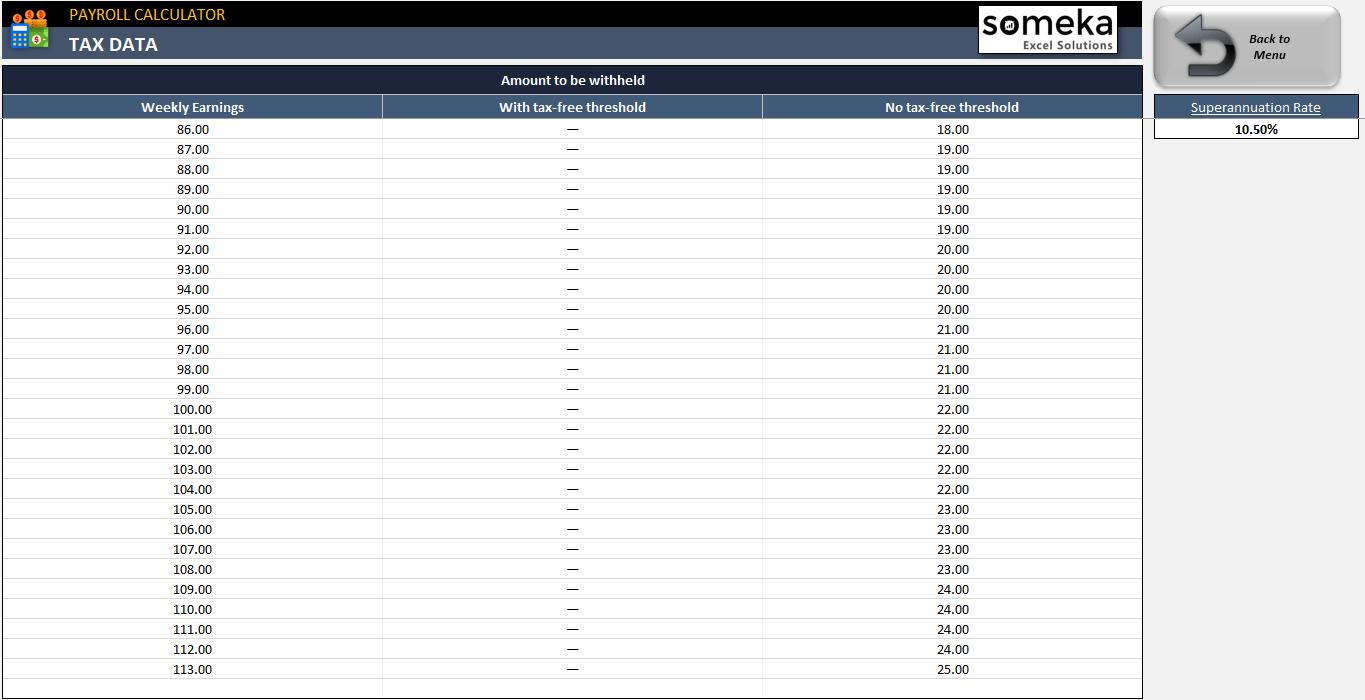

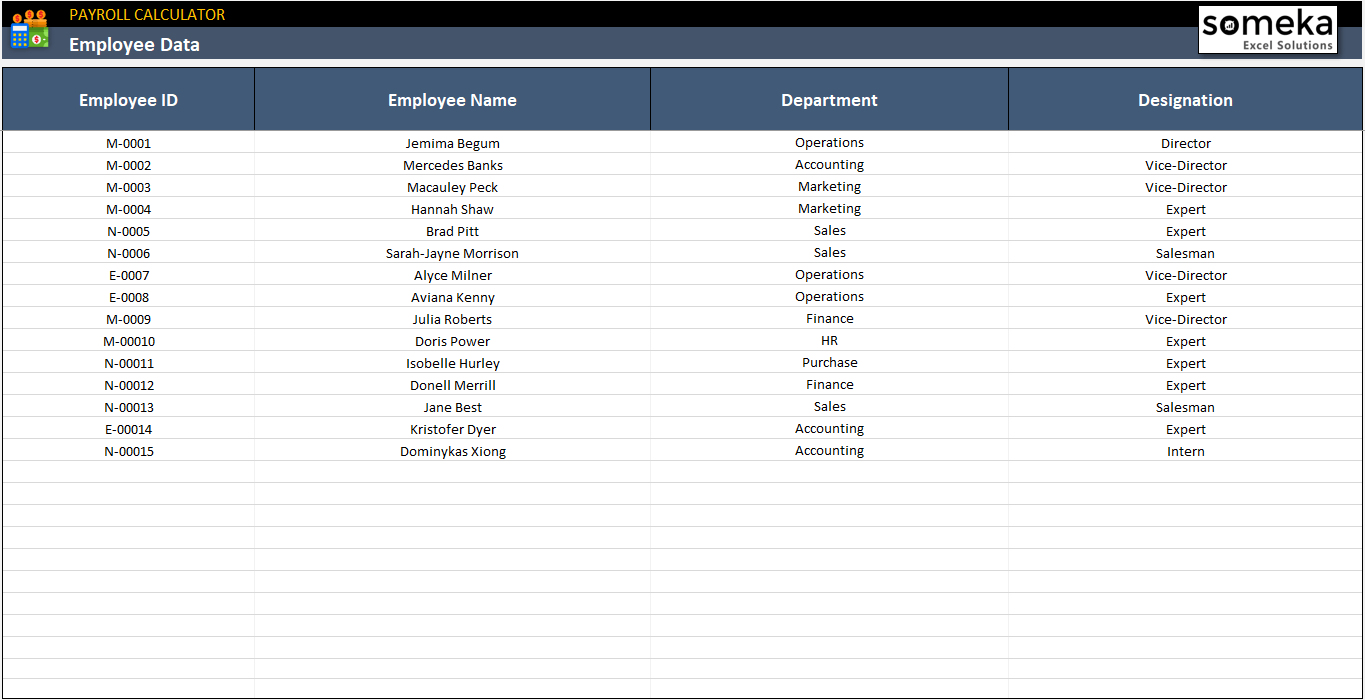

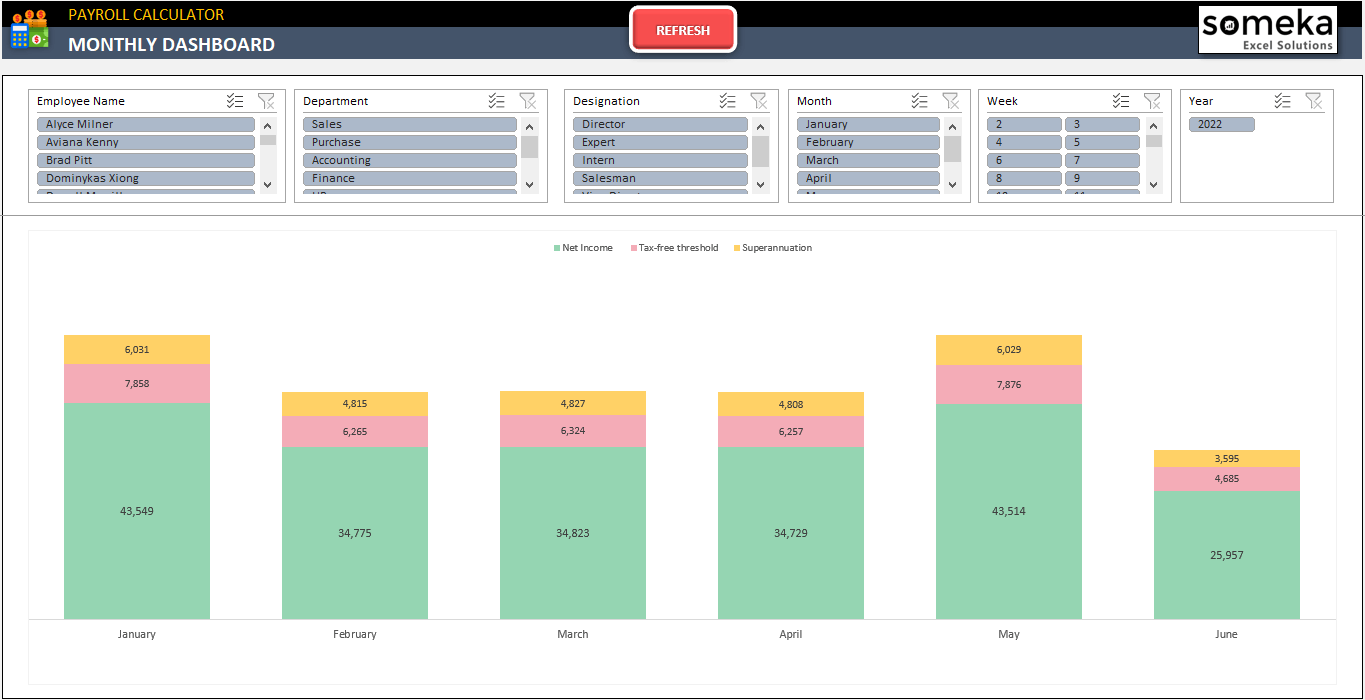

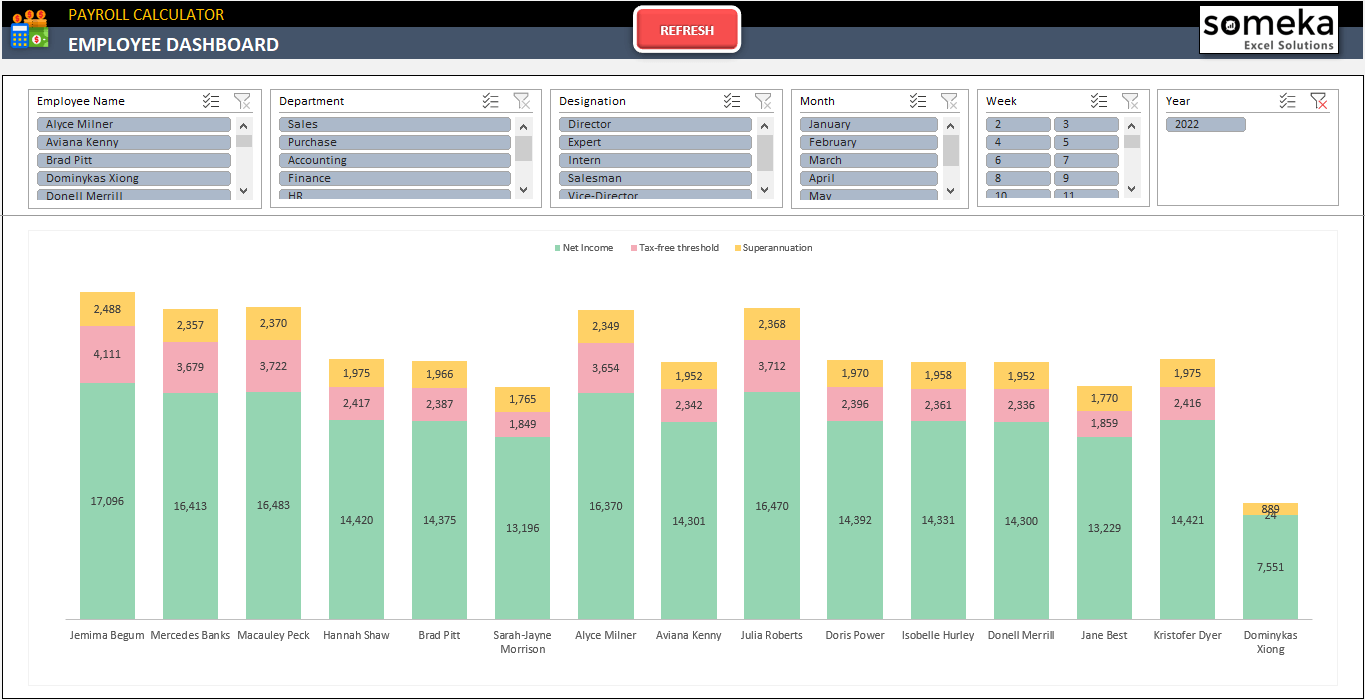

This Payroll Calculator Excel Template supports as many employees as you want. Business and organisations Ngā pakihi me ngā whakahaere. Payroll Calculator Excel Template Features Summary.

After the calculator Ill discuss the different inputs. You may begin using the payroll application at any time during the year. If your personal or financial situation changes for 2022 for example your job starts in summer 2021 and continues for all of 2022 or your part-time job becomes full-time you are encouraged to come back in early 2022 and use the calculator again.

Try paystub maker and get first pay stub for free easily in 1-2-3 steps. University Personnel formerly Human Resources and Faculty affairs provides a variety of services to all faculty staff and student employees at San José State University. Learn about the benefits of this safe and fast way of getting your pay directly on your bank account.

What would my loan payments be. Heres a quick easy-to-use calculator that can help you determine the effect of changing your payroll adjustments on your take-home pay. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

UPB Customer Service is available to help employees and departments understand and work payroll and benefits processes. How Do I Make My Quarterly Payments. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax.

IRD numbers Ngā tau. Income tax Tāke moni whiwhi mō ngā pakihi. Responding to thousands of requests for assistance every month.

People and businesses with other income. You must enter payroll data directly into your SurePayroll account if you. Estimated tax is the method used to pay Social Security and Medicare taxes and income tax because you do not have an employer withholding these taxes for you.

Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. The PaycheckCity salary calculator will do the calculating for you. Dont want to calculate this by hand.

Free Online Timecard Calculator with Breaks and Overtime Pay Rate Enter working hours for each day optionally add breaks and working hours will be calculated automatically. April Young Ultimate Properties. KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi.

Learn how you can save 100s or even 1000s of dollars. In addition to this our Paycheck Tracker has a dashboard to see cumulative earnings as well as a separate section to print out the selected employees payments. We offer free payroll setup to help you get your account set up and can enter all payroll history for you.

In addition to our free salary paycheck calculator our payroll calculators page contains an hourly paycheck calculator among many others. Then enter the employees gross salary amount. Learn what to do if your paycheck is lost stolen or damaged.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. What is the value of my business. This number is the gross pay per pay period.

Each April many taxpayers are surprised as they realize that they have either over withheld or under withheld on their taxes. Subtract any deductions and payroll taxes from the gross pay to get net pay. If you want to calculate total gross pay enter hourly pay rate and choose.

However the total payroll amount used and requested must match to qualify for the maximum loan forgiveness. Calculating payroll deductions doesnt have to be a headache. Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule.

Updated with current IRS withholding information for 2018. Check out the Frequently Asked Questions about pay. Lowest price automated accurate tax calculations.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Just choose the strategy from a dropdown box after you enter your. We wouldnt use any other payroll solution and recommend them to any small business owner.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Employing staff Te tuku mahi ki ngā kaimahi. PaycheckCity Payroll has made us more productive and has saved hundreds of hours of time when running our payroll.

Goods and services tax GST Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha. Please visit the University Payroll Benefits Service Portal if you have any payroll or benefits questions. Estimates made using these payroll calculators will not affect SurePayroll account information.

Enroll in Direct Deposit. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate Payroll For Hourly Employees Sling

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator With Pay Stubs For Excel